ASSET-BASED MICROFINANCE FOR MICROENTERPRISES IN PAKISTAN

OUR AIMS

Is microfinance too ‘micro’? Can larger financial products generate sustained improvements in microenterprise performance? The first wave of microfinance RCTs found modest average impacts of conventional microcredit contracts on microenterprise performance, and practically zero effects on household consumption. Subsequent work has identified significant heterogeneity in business impacts, and several papers show benefits from contractual innovations designed to increase repayment flexibility. In their seminal review of the experimental literature, Banerjee, Karlan, and Zinman (2015) recommend that the next generation of microfinance research should explore contractual innovations and non-credit structures, while addressing the lack of evidence for the impact of larger financing amounts on graduated borrowers.

In this project, the research team directly address this gap in the literature, with a focus on asset-based microfinance contracts. Researchers explore the impact of asset-based microfinance contracts offered to graduated microenterprise borrowers.

ABOUT THE PROJECT

In this project, the research team work with Akhuwat, one of the most prominent microfinance institutions (MFIs) in Pakistan. Akhuwat has a large pool of borrowers who have successfully completed previous loan cycles, and who want to expand their business through the purchase of a fixed asset that cost significantly more than the prevailing borrowing limit. To finance such a large amount in a manner that is satisfactory to the MFI’s risk-reward perspective, the research team rely on a collateralised asset financing structure that has not previously been used in the experimental microfinance literature: namely, a ‘hire-purchase’ agreement, in which the client’s ownership share in the asset increases as repayments are made.

The researchers conduct a field experiment in which they offer these graduated microfinance borrowers the opportunity to finance a business asset worth up to approximately two thousand US dollars, which represents a large capital injection for these clients: approximately four times their previous borrowing limit, and substantially more than the loan amounts offered in most of the comparable research. The team offer two variants on a hire-purchase contract, each with an 18-month duration and each allowing clients to purchase an asset of their choice. They are:

- a fixed-repayment contract where participants are obliged to buy the asset within 18 months;

- and a flexible-repayment contract that provides a greater element of risk sharing by allowing either faster or slower repayment, at the client’s discretion.

In both contracts, clients are required to pay rent based on the MFI’s proportional ownership share of the asset at the start of each month. Clients who were randomly assigned to the control group were eligible for the MFI’s standard cash loan with a $475 borrowing limit.

RESULTS

The team find relatively high take-up rates for our two products (57% on average), and low default rates (under 5% for both contracts). Most importantly, researchers find large and significant effects from both treatments on business and household outcomes, using five rounds of follow-up data in the two years following this intervention.

Specifically, treatment clients are more likely to:

- remain in self-employment;

- have larger businesses (as measured through business assets);

- better business management practices (particularly in terms of inventory control and purchasing);

- and greater business performance (on average, an increase in monthly business profits of approximately 9% of the control group mean).

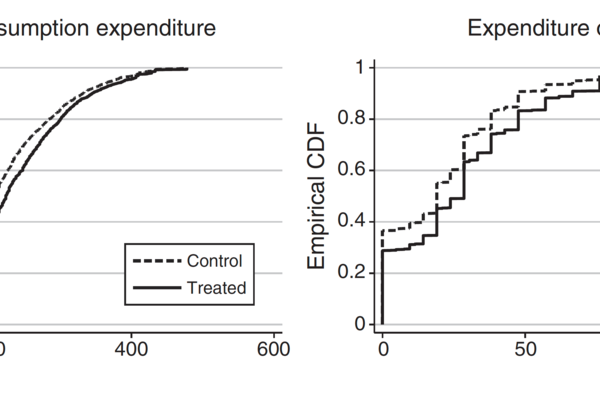

This generates a significant increase in household income (on average, approximately 8% per month), and a significant increase in household monthly consumption expenditure (approximately 6%). The bulk of this increased consumption is in household educational expenditure, where we observe a 26% average increase compared to the control group. This is predominantly driven by an increase in spending on girls’ education, significant across all measured subcategories: spending on school fees, books and materials, school meals, and transportation costs. The team also find significant positive effects on overall purchases of food for the household.

The researchers also estimate a dynamic structural model with non-convex capital adjustment costs, which rationalises the results. This highlights the potential for welfare improvements through large capital injections that are financially sustainable for microfinance institutions.